| About Us | Contact Us | Calendar | Publish | RSS |

|---|

|

Features • latest news • best of news • syndication • commentary Feature Categories IMC Network:

Original Citieswww.indymedia.org africa: ambazonia canarias estrecho / madiaq kenya nigeria south africa canada: hamilton london, ontario maritimes montreal ontario ottawa quebec thunder bay vancouver victoria windsor winnipeg east asia: burma jakarta japan korea manila qc europe: abruzzo alacant andorra antwerpen armenia athens austria barcelona belarus belgium belgrade bristol brussels bulgaria calabria croatia cyprus emilia-romagna estrecho / madiaq euskal herria galiza germany grenoble hungary ireland istanbul italy la plana liege liguria lille linksunten lombardia london madrid malta marseille nantes napoli netherlands nice northern england norway oost-vlaanderen paris/Île-de-france patras piemonte poland portugal roma romania russia saint-petersburg scotland sverige switzerland thessaloniki torun toscana toulouse ukraine united kingdom valencia latin america: argentina bolivia chiapas chile chile sur cmi brasil colombia ecuador mexico peru puerto rico qollasuyu rosario santiago tijuana uruguay valparaiso venezuela venezuela oceania: adelaide aotearoa brisbane burma darwin jakarta manila melbourne perth qc sydney south asia: india mumbai united states: arizona arkansas asheville atlanta austin baltimore big muddy binghamton boston buffalo charlottesville chicago cleveland colorado columbus dc hawaii houston hudson mohawk kansas city la madison maine miami michigan milwaukee minneapolis/st. paul new hampshire new jersey new mexico new orleans north carolina north texas nyc oklahoma philadelphia pittsburgh portland richmond rochester rogue valley saint louis san diego san francisco san francisco bay area santa barbara santa cruz, ca sarasota seattle tampa bay tennessee urbana-champaign vermont western mass worcester west asia: armenia beirut israel palestine process: fbi/legal updates mailing lists process & imc docs tech volunteer projects: print radio satellite tv video regions: oceania united states topics: biotechSurviving Citieswww.indymedia.org africa: canada: quebec east asia: japan europe: athens barcelona belgium bristol brussels cyprus germany grenoble ireland istanbul lille linksunten nantes netherlands norway portugal united kingdom latin america: argentina cmi brasil rosario oceania: aotearoa united states: austin big muddy binghamton boston chicago columbus la michigan nyc portland rochester saint louis san diego san francisco bay area santa cruz, ca tennessee urbana-champaign worcester west asia: palestine process: fbi/legal updates process & imc docs projects: radio satellite tv |

printable version

- js reader version

- view hidden posts

- tags and related articles

View article without comments From Scarcity to Glut?by Norbert Nicoll Tuesday, Sep. 30, 2014 at 4:19 AMmarc1seed@yahoo.com The industrial countries practice a lifestyle of non-sustainability and consume the resources of the earth too quickly. This is true for energy, raw materials and metals. Still the knowledge of oil's finiteness cannot be evaded. We should use this time to develop alternative energy infrastructures. FROM SCARCITY TO GLUT?

Fracking, Tar Sands and the New Fossil Energy Optimism By Norbert Nicoll [This article published in FORUM Wissenschaft 9/5/2014 is translated abridged from the German on the Internet, http://www.linksnet.de/de/artikel/31628. Dr. Nicoll is a Belgian political scientist and economist who researches growth criticism and sustainable development at the University of Duisberg-Essen.]] Crude oil was and is the central fuel of the world economy. But will that be true in the future? Three years ago an oil scarcity was expected beginning gradually around 2015. [1] Many studies predicted the imminent appearance of Peak Oil. In the meantime the picture has changed. Instead Norbert Nicoll sees a new energy optimism based on the introduction of new production methods. Slightly simplified, Peak Oil means half of the crude oil is consumed. As a consequence, oil production cannot be increased any more. Sooner or later, it falls. A growing world economy relies on growing oil consumption and a growing oil production. If the “black gold” becomes scarce, the prices could soar and stifle all economic growth. In the last years, followers of the Peak Oil theory who predicted a rapid decline of oil production and understood the wars in Iraq (2003) and Libya (2011) as resource wars sustained a few scratches. In 2013 the world consumed 89 million barrels of oil daily. [2] Oil production increased. One essential reason is so-called hydraulic fracturing (in short, fracking) that increased oil- and gas production in the US to a surprising extent. Another cause is found further north on the map. The tar sands in the Canadian province of Alberta cause a sensation. Canada has become an energy power. In addition, oil consumption in industrial countries is falling. This has to do with advances in energy efficiency and energy savings. The demand growth comes almost exclusively from threshold- and developing countries led by China. [3] In an unexpected development in 2005, the International Energy Agency (IEA) with headquarters in Paris estimated the oil demand in 2030 at 130 million barrels daily. In 2007 the IEA forecast an oil need of 116 million barrels per day in 2030. In its most recent report World Energy Outlook 2013, the IEA estimates the daily worldwide oil need for 2035 at 101 million barrels. [4] An increasing supply faces a lower demand. Do we face an oil glut as some representatives of the oil industry euphorically claim and no longer an era of oil scarcity? This article will try to illuminate this question. The time of cheap oil available in abundance is definitively over. However an oil scarcity cannot be expected in the short- or medium-term – assuming the world remains spared political crises in important producer countries. TWO FORMS OF OIL The distinction between conventional and unconventional oil is important. Conventional oil is the oil that can be brought to the surface in liquid form with classical production methods [5]… Unconventional oil includes tar sands, heavy oil, oil shale and synthetic oil from biomass, natural gas and coal as well as the so-called tight oil, oil brought to the earth’s surface by fracking. The reserve estimates of unconventional oil are extremely different. Reserves are not everything. For Peak Oil, the quantity of oil reserves in the ground plays an important role. However two questions are far more important: At what speed can crude oil be produced? What are the costs of this production? The mammoth conventional oil fields release less and less black gold. This is controversial. Different conventional oil fields are in operation. Most of these are much smaller and less productive than the enormous elephant fields. A gap exists between the oil demand and the oil supply from conventional oil wells. The International Energy Agency quantifies this gap in its latest outlook for 2035 at 14 million barrels per day. Is this reason for alarm? No, the IEA says, this gap will be completely closed by unconventional oil wells. [6] Critics regard this estimate as too optimistic. [7] FAVORITE OF WALL STREET For five years, unconventional oil resources have been among the favorites of Wall Street. Some time ago Citigroup launched a study that declared the end of Peak Oil. “The Peak Oil concept is buried in North Dakota,” the bankers exclaimed euphorically. In the first sentence of their analysis [8], North Dakota was called the new Mecca of the oil industry. Another giant of the financial branch blows the same horn. In a recent study, Price Waterhouse predicted a rich oil supply in the future. The price of oil will fall, not rise by 2035. Economic growth will be stimulated by a new energy revolution. [9] The reason for the euphoria is hydraulic fracturing. This process is not new but was not counted in the past. Hydraulic fracturing was first used for shale gas resources. Shale gas lies in a very thick rock. This rock releases the gas under great effort. In a simplified way, the process can be described as follows. First, the spacious deposits are drilled horizontally. Then extreme high pressure water mixed with a chemical cocktail is introduced. The pressure of the water bursts the stone so the gas can escape. In the US, fracking has led to more gas being burned for power generation – at the expense of coal. The official US emission balance has improved because less coal is burned. Many question marks should be attached to this statement. Massive quantities of methane gas are released in bursting the stone. How much methane reaches the atmosphere is unclear since this release process is not monitored. The scientific studies on this theme are rather thin but many findings indicate fracking does not contribute to protection of the atmosphere. [10] On the other hand, the conclusions regarding groundwater are very clear. In the US, important environmental standards in water pollution control were abandoned before fracking could be used on a broad front. This was not without consequences. Impurities of the groundwater occurred. Fracking damages the health of humans and animals. Remnants of heavy metals have been found in frack waste water that flusters up the hormone content. Endocrine studies are underway. The first results are alarming. Given these risks, citizen initiatives against the oil- and gas industry are springing from the ground like mushrooms. Despite all the resident protests, there are more and more drillings. The results are simply too good from the view of industry – so good that some industry representatives fall into boundless euphoria. “By opening up unconventional gas, the global provisions are multiplied and ensure provisions for around 300 years. Thanks to shale gas, the US is on the best way to energy autonomy,” said Stephan Reimelt, CEO of General Electric Energy in Germany. [11] For some years, hydraulic fracturing has been a bearer of hope in the oil industry. Oil reserves are in extremely dense rocks that cannot be produced conventionally. Experts speak of tight oil. [12] That tight oil should be forced out by hydraulic fracturing. Oil fracking projects in shale formations have been successful in some states like North Dakota. In the last years, they were expanded on a large scale prompting Citigroup economists to forecast the death of Peak Oil theory. The Price Waterhouse Coopers’ study authors believe 14 million additional barrels of oil will come to the oil market by 2015. A TOTTERING BUSINESS A great mass of material opposes this estimate. The new resources will be exhausted very quickly, so quickly there cannot be any comparison to conventional oil- and gas fields operating for many decades. In addition, opening unconventional oil- and gas resources by fracking is difficult and costly. In the allegedly very successful gas-fracking, production decline on average 60 to 90 percent within a year after the start of production, experiences in the US show. [13] Other authors speak of a production-decline of 80 to 95 percent after three years. [14] Experiences with released tight oil are similar. In North Dakota, production from new drill holes fell 50 percent on average after one year. After four years, only a tenth of initial production was left. This production course is a direct consequence of the fracking technology and the rupture in the stone that it created or expanded. The artificially created cracks are greatest in the first moments after the hydraulic “fracking.” [15] “Economically fracking is a catastrophe,” the US financial journalist Wolf Richter writes in Business Insider. “The drillings destroy capital at an astonishing speed. When the fatal production decline started, the operators sat on a mountain of debts. So this decline did not damage the balance sheet, the loss of the old wells had to be replaced by ever new drillings – until they become dry.” [16] This quotation refers primarily to gas-fracking. Many gas-frackers are financially in the red. The picture with oil-fracking is substantially better. Still the cited numbers for fracking put in question the good management or efficiency of the new production technology. The serious environmental- and health damages are not even included in a good management accounting. The internationally renowned geologist David Hughes is convinced many dreams around fracking will prove to be dreams. Hughes presented a 181-page referenced study [17] that ensures a sobering up. Measured by the enormous hype, the oil amounts produced by fracking in the US are relatively minor. Altogether the US tight oil production in 2013 amounted to 3.5 million barrels per day. By 2021 this amount will rise to 4.8 million barrels per day. [18] This counteracts the production decline of conventional oil fields but does not justify the estimate expressed sometimes in the media that the US will become the new Saudi Arabia. The optimistic predictions of Citigroup and Price-Waterhouse Coopers should be at least grounded if not refuted. The next years will show what fracking potential develops in the oil economy. There are many indications that fracking will prove to be an investment bubble. The energy journalist Richard Heinberg says Wall Street will profit most from the whirlwind around fracking. While the effects on the real work of oil- and gas businesses are trifling, the stock prices on the exchanges have soared dramatically. Investment banks like Goldman Sachs filled their pockets by “hyping” businesses from the oil branch. For Heinberg, “the real profits of this technology were greatly exaggerated and the risks played down.” [19] OILSANDS IN CANADA All those who want to know nothing about a future oil scarcity often point to the gigantic oil sands reserves that exist in Venezuela (Orinoko region) and in the Athabasca region (province of Alberta) in Canada. Why should oil sands be developed if there will not be a sufficient number of conventional oil wells easy to develop? (The same question could obviously be raised with regard to fracking.) The oil sands in the northeast of the Alberta province are the largest oil resources of the world at least theoretically. The resources extend over an area of 540 square miles. According to data of the Canadian oil corporation Syncrude, 1.7 trillion barrels of bitumen, a very heavy oil mixture, are stored there. According to Syncrude, 175 billion barrels can be produced conventionally and another 315 billion with expected technical progress. [20] The oil sands deposits in Canada are very considerable. This is more a theoretical reflection. Unlike the classical oil production countries, the oil lies mostly 100 feet below the surface as a tough-sticky heavy mixture of sand, clay and other minerals. For a long time, oil sands were regarded as uneconomical. The high oil price made oil sands processing into a boom industry. Oil production in Canada devours enormous energy (above all natural gas), is relatively expensive and has much in common with mining. Around two tons of oil sands must be processed to gain one barrel of oil. Three barrels of water per barrel of oil are needed; great tracts of land are transformed into moonscapes. Water is taken from the Athabasca River. The residues, 500 million liters per day, are so intensely encumbered with arsenic, mercury and other toxins that they are held in special reservoirs. Basins with liquid residues from production already extend over 19 square miles, the environmental World Wide Fund for Nature Canada reports. Oil production is planned to rise to six million barrels per day by 2030. 18 million barrels of water will be needed everyday with this technology. That would be an incredible 2.86 billion liters of water. This amount would supply around 1.4 billion people with vital liquid daily. [21] Environmentalists criticize that massive amounts of natural gas will be burned to produce the oil and an immense expulsion of carbon dioxide. The sand will be excavated or dredged out of the soil in the winter at temperatures of minus 30 to minus 50 degrees Celsius. The heavy clods must be crushed and the water necessary for the reprocessing heated. All this devours energy. Every year up to 170 million birds hatch in the forests. They could lose their living space to the strip mining. Future bird generations could lose their foundations of life. [22] The Canadians are only making a relatively small contribution to solving future energy problems. The comparatively modest production speed and quantities are decisive. The International Energy Agency expects oil production from oil sands to rise from 1.8 million barrels per day in 2012 to 4.2 million barrels per day in 2035. [23] The Canadian Association of Petroleum Producers (CAAP) is even more optimistic and estimates an oil sands production of 4.2 million barrels in 2025. A daily production of five million barrels is predicted for 2030. [24] These predictions are doubted by skeptics. [25] Still five million barrels a day from oil sands would not be enough to compensate for the declining production from conventional oilfields. Moreover the risk exists that the great amount of natural gas streaming through the oil sands processing facilities could be re-channeled. Natural gas is now clearly cheaper than oil. A rising natural gas price could lead to using natural gas in other ways – for example, heating houses and apartments or producing electricity. [26] THE FUNDAMENTAL PROBLEM IS UNCHANGED Oil can certainly be gained in other ways. Bio-fuel is a prominent example. Oil can be produced with the help of coal and gas. Moreover considerable oil shale deposits that could be processed exist in the Green River Basin (the largest part of the basin lies in Utah and Colorado). A detailed essay could be written on each of these themes. The production speed and the production costs are crucial, not the reserves. Many oil firms need an oil price from $120 to $130 per barrel to maintain their profit level and the amount of their dividend payments. [27] The picture is not better than with fracking or the oil sands. The much reviled defenders of maximum oil production could carry the day at the end. They will need a long breath. But time is on their side. Oil is a finite material. The world’s annual oil consumption is now 30 billion barrels. 14 billion barrels are discovered per year. [28] Thus nothing has changed in the fundamental problem. The industrial countries practice a lifestyle of non-sustainability and consume the resources of the earth too quickly. That is true for energy, raw materials and metals. We will not quickly abandon oil. Still the knowledge of its finiteness cannot be evaded. Along with better technology, unconventional black gold has given us additional time. We should use this time to develop alternative energy infrastructures. NOTES 1) Vgl. Nicoll, Norbert 2011: "Das Öl verlassen, bevor es uns verlässt", in: Forum Wissenschaft, Nr. 4, 2011: 10-13. 2) Barrel heißt übersetzt schlicht "Fass". Ein Barrel entspricht 158,98 Liter. 3) Vgl. Internationale Energie-Agentur (Hg.) 2013: World Energy Outlook 2013, Paris: 504. 4) Vgl. ebenda: 55. 5) Reserven sind als die Gesamtheit der Rohstoffvorkommen definiert, die nach heutigem Stand technisch und wirtschaftlich gewinnbar sind. Ressourcen sind dagegen all jene Rohstoffvorkommen, die derzeit technisch wie wirtschaftlich nicht gewinnbar sind. 6) Vgl. Internationale Energie-Agentur (Hg.) 2013: World Energy Outlook 2013, a.a.O.: 25f. 7) Alternative Einschätzungen finden sich u.a. bei der Energy Watch Group (http://www.energywatchgroup.org/) und bei der Association for the Study of Peak Oil & Gas (http://www.peakoil.net/). 8) Citigroup Global Markets (Hg.) 2012: Resurging North American Oil Production and the Death of the Peak Oil Hypothesis, o.O.: 1. 9) Vgl. PriceWaterhouseCoopers (Hg.) 2013: Shale oil: the next energy revolution, o.O.: 1 und 3. Online unter: http://www.pwc.com/en_GX/gx/oil-gas-energy/publications/pdfs/pwc-shale-o... [Stand: 3.2.2014]. 10) Vgl. Wagner, Karl 2013: "Es werden keine Gefangenen gemacht: gegenwärtige Trends der Ausbeutung des Planeten", in: Bardi, Ugo: Der geplünderte Planet. Die Zukunft des Menschen im Zeitalter schwindender Ressourcen, München: 21-28; hier: 23f. 11) Reimelt, Stephan 2012: "Versorgungssicherheit gefährdet", in: Die Welt vom 14. April 2012, Beilage Energie 2012 - Effizienz und Nachhaltigkeit: 1. 12) Als Laie muss man sich das so vorstellen: Öl verbringt nicht sein ganzes Leben lang am gleichen Ort. Es bildet sich in einem sogenannten Muttergestein und fließt dann in eine höhere Erdschicht, durchläuft ein poröses, gut durchlässiges Gestein. Jene von GeologInnen "Reservoir" genannte Schicht wird von einer weiteren Schicht überlagert - der sogenannten Erdölfalle. Dort sammelt sich das Öl im Idealfall in einer großen, gut förderbaren Menge. Beim Tight Oil findet sich das Erdöl nicht in der Erdölfalle, sondern eingeklemmt in einer tiefer liegenden Gesteinsschicht. 13) Vgl. King, David / James Murray 2012: "Oil's tipping point has passed", in: Nature, Nr. 481: 433-435; hier: 435. 14) Vgl. Hughes, David 2013: "A reality check on the shale revolution", in: Nature, Nr. 494: 307-308; hier: 308. 15) Vgl. Senz, Christoph: "Der Tight Oil Boom in den USA - Ein genauerer Blick! Teil 2". Online unter: http://www.peak-oil.com/2013/02/der-tight-oil-boom-in-den-usa-ein-genaue... [Stand: 4.2. 2014]. 16) Zitiert nach: Ahmed, Nafeez Mosaddeq 2013: "Die nächste Blase. Fracking löst das Energieproblem nicht", in: Le Monde diplomatique vom 12.4.2013. 17) Hughes, David 2013: "Drill, Baby, Drill: Can Unconventional Fuels Usher in a New Era of Energy Abundance?", Post Carbon Institute, Santa Rosa. Online unter: http://www.postcarbon.org/reports/DBD-report-FINAL.pdf [Stand: 2.1.2014]. 18) Diese Angaben stammen von der U.S. Energy Information Administration. 19) Vgl. Heinberg, Richard 2013: Snake Oil. How Fracking's false promise of plenty imperils our future, Santa Rosa: 92. 20) Vgl. Resenhoeft, Thilo 2009: "Im Sand von Kanada lauern riesige Ölreserven", in: Die Welt online vom 2.3.2009. Artikel online unter: http://www.welt.de/wissenschaft/article3299733/Im-Sand-von-Kanada-lauern... [Stand: 14.7.2013]. 21) Vgl. Wiesmann, Otto 2009: Chance Peak Oil?, München: 71. 22) Vgl. Resenhoeft, Thilo: a.a.O. 23) Vgl. Internationale Energie-Agentur (Hg.): "World Energy Outlook 2010. Fact Sheet". Online unter: http://www.worldenergyoutlook.org/docs/weo2010/factsheets.pdf [Stand: 8.11.2013]. 24) Vgl. Canadian Association of Petroleum Producers (CAAP): "2012 Crude Oil Forecast, Markets and Pipelines Outlook". Online unter: http://www.capp.ca/forecast/Pages/default.aspx [Stand: 21.7.2013]. 25) Der schon erwähnte Geologe David Hughes sieht sowohl die Prognose der IEA als auch der CAAP als übertrieben optimistisch an. 26) Vgl. Rubin, Jeff 2010: Warum die Welt immer kleiner wird: Öl und das Ende der Globalisierung, München: 49. 27) Das ist jedenfalls die Berechnung der Analysten von Douglas-Westwood Associates, einer renommierten Agentur im Energiebereich. 28) Das ist der Durchschnitt der letzten Jahre. Tendenziell haben sich die Neufunde stabilisiert.

Report this post as:

How the oil and gas boom is changing Americaby Brad Plumer Friday, Oct. 03, 2014 at 12:59 PMto read Brad Plumer's article published on Oct 2, 14, click on

http://www.vox.com/2014/10/2/6892781/how-the-oil-and-gas-boom-is-changing-america

Report this post as:

Shale Oil Boom Breaking Downby crazy_inventor Friday, Oct. 03, 2014 at 1:09 PM

Recent research suggests that fracking causes earthquakes; they have no doubt of that at the fourth largest trading and investment company in Japan — Sumitomo Corporation — which has just experienced a Magnitude 10. The profit Sumitomo expected to make this year, a hefty $2.27 billion, has been all but wiped out. News of the disaster atomized 13 per cent of its stock value in one day. Its credit rating went to “negative.” And almost all of this was caused by hideous losses incurred in fracking for tight oil in Texas.

Sumitomo samurai rolled into Texas just two years ago (seems like only yesterday) with a $2 billion dollar investment in the Permian shale-oil play, in partnership with Devon Energy of Oklahoma. So here we have Japan’s fourth-largest trading company, along with one of the largest US fracking companies, going into the (potentially, according to the oil interests) richest tight-oil basin in the United States in the midst of a tight oil boom. What could possibly go wrong? Sumitomo has no idea. They have appointed a committee to try to figure it out. “It is difficult,” said a dazed-sounding statement from the top, “to extract the oil and gas efficiently.” They could not, as it turned out, expect enough production “to recover the investment.” Wow. Not much of a business plan there. What Sumitomo missed, as its investigating committee may or may not figure out, is that fracked wells are not at all like normal oil wells: they are twice as expensive to set up, many times more expensive to operate, and run out 10-20 times faster. The simple fact is that the wells are not paying for themselves. They look like they are going to, in their first year, but by the third or fourth year it’s clear that they are not going to. (For a devastating explanation of this point by the former head of research for a London money broker, see “Shale Gas: The Dotcom Bubble of Our Times.”) Sumitomo is not alone in its mystification. Itochu Corporation, Japan’s third largest trading company, has written off 80 percent of a nearly $80 million investment in a US fracking company. And then there is Shell, which took a $2 billion hit last August as punishment for its shale-oil and -gas enthusiasm, and this year bailed out of a business in which it had been one of the largest players. Every Ponzi scheme and bubble is based on the Greater Fool hypothesis of investing, which is that the real value of the assets you’re buying don’t matter as long as you can find a greater fool, someone who knows even less about the assets than you do, who will buy them from you. When you run out of fools, the market crashes. With Sumitomo bailing now — that is, selling its leases — the search for the next greater fools is becoming really intense. They are going to experience peak fools very soon. And then there is going to be an earthquake we will all feel.

Report this post as:

Rats Start to Leave the Fracking Shipby crazy_inventor Friday, Oct. 03, 2014 at 1:12 PMtop oil people are starting to do about the fracking revolution. Abandoning ship

The first sign of a doomed ship is said to be the urgent departure of its rats; the first sign of fire in a crowded theater is not the guy who shouts it out, but the several people with good noses who start to sidle quietly but purposefully toward the exits. In the world of America’s bogus oil and gas fracking revolution, the nostrils of the rats and the smoke-sensitive alike are beginning to twitch. Let us watch those noses.

Must we review the industry’s propaganda again here? How hydraulic fracking has changed everything, America now has abundant gas and oil, we’re surpassing Russia and Saudi Arabia, we’re number one in the world again, we’re headed for energy independence? (No one has yet had the chutzpah to predict we’re going to get to energy independence, since it’s mathematically impossible, but it shouldn’t be long now, they’re getting desperate.) The latest iteration of the industry line is an essay that appeared in the New York Times titled “America’s Oil Bonanza,” a song of oil without end, amen. Meanwhile, one of the top oil commodity traders in the world — in other words, one of the big rats who have been playing in the oil market as if it were a big casino, as if no one got hurt by their machinations — is tip-toeing down the mooring lines of the shale oil revolution in search of safer ground. His name is Andrew John Hall, and he says shale-oil production in the United States is about to fall off a cliff. Not that he gives a frack. He is worshiped by his fellow Masters of the Universe (Yes, worshiped — they call him the god of crude oil trading) because for his skills in the oil casino he used to get $100 million annual bonuses from Citi Bank until the last flameout, when the Feds suspended them on the grounds that they were obscene. Now, he’s placing his bets and those of his worshipful clients on fracking production nosediving in the United States in about a year (and failing for various reasons to get rolling in other countries) and crude oil prices almost immediately hitting $150 per barrel. Traders who hold long-term contracts for delivery of crude at today’s prices — $100 or a little less — will make gazillions. Hard to know how they’re going to spend it, though, since oil prices much above $100 cause nasty recessions in all industrialized countries. Others, oil guys deeply involved with the bidness, seem to be sidling toward the exits, nostrils twitching. Royal Dutch Shell, one of the biggest players in the fields of fracking — it amassed at least $13 billion in leases in five years, starting in 2008 — appears to be leaving the building. While laying down a fog of statements about “restructuring… refocusing… renewed commitment” and the like, the company seems to have all but abandoned the North American shale business (in which, interestingly, it never made any money). British Petroleum seems to be executing a similar tiptoe toward the EXIT sign. It has rolled all its American shale holdings into a company that doesn’t even bear its name (how low do you have to go before you’re too disreputable to be known as BP?) which is often a precursor move to a sell-off. BP’s CEO now dismisses the fracking revolution as a “lower margin, lean business” more suited to “independent operators,” otherwise known among con artists as “greater fools.” And he talks excitedly about how well the company is going to do with new deepwater wells in the Gulf of Mexico. Yeah, that ought to go well. Hard to see what could go wrong with that. Pay very close attention to the mooring lines and the exits in the coming months. You might not want to associate with the first people fleeing (and leaving women and children to their own devices) but you might want to follow suit. For the sake of your women and children. www.dailyimpact.net/2014/09/06/rats-start-to-leave-the-fr...

Report this post as:

ah yes - the tesla SCAMby crazy_inventor Friday, Oct. 03, 2014 at 1:20 PMthe vox fluff piece uses tesla as a prop

another Tesla Model S Fire

"we've seen Tesla posting its first quarterly profits, selling thousands of cars in a quarter, winning all sorts of awards" Lemon Update Actual use of Tesla’s $90,000 jalopy has apparently changed Consumer Reports‘ views. Per Automotive News: Consumer Reports, which last year gave top marks to electric carmaker Tesla Motors Inc.’s Model S sedan, now says the car it owns has had “more than its share of problems.” Consumer Reports, which anonymously buys the vehicles it tests from auto dealerships, said Monday the Model S it owns now has traveled nearly 16,000 miles. Its 2013 Model S was purchased for $89,650 in January of that year. “Just before the car went in for its annual service, at a little over 12,000 miles, the center screen went blank, eliminating access to just about every function of the car,” the magazine said in its statement. Tesla fixed the issues on the magazine’s Model S under warranty. The repairs included a “hard reset” to restore the car’s functions after its center screen went blank and problems with the automatic retracting door handles, which were occasionally reluctant to emerge. CR isn’t the only one: The issues highlighted by Consumer Reports follow a report by Edmunds.com, an automotive data and pricing company in Santa Monica, Calif. It reported problems last month with its Model S that included replacing the main battery pack after incidents in which the car stalled; a frozen touchscreen; a creaky steering wheel and difficulties opening the car’s sunroof. As always, Elon Musk responds to these reports like the petulant six-year-old who just broke the family lamp: Tesla CEO Elon Musk said last month the company continues to review customer reports to ensure all known flaws with the car are fixed. “We definitely had some quality issues in the beginning for the early serial number cars, because we were just basically figuring out how to make the Model S. I think we’ve addressed almost all of those for current production cars,” Musk told analysts on a July 31 conference call. “Every week I have a product excellence meeting which is a cross-functional group, so we’ve got engineering, service and production and we go over all the issues that customers are reporting with the car and the action items that have to be addressed to get the car ultimately to the platonic ideal of the perfect car.”

Report this post as:

..and you techno-hopium peddlers are sure to love this:by crazy_inventor Friday, Oct. 03, 2014 at 1:30 PM

$ 90,000 dollar tesla car drops 3 miles (off it's 'gas guage') for every mile that you actually travel, with the heat on.

these cars are in reality COAL powered, since the electricity they use is generated by coal. green my ass

Report this post as:

Human Hothouse Found to be California Drought Culprit as Ridiculously Resilient Ridgeby crazy_inventor Friday, Oct. 03, 2014 at 1:34 PM

Reasserts

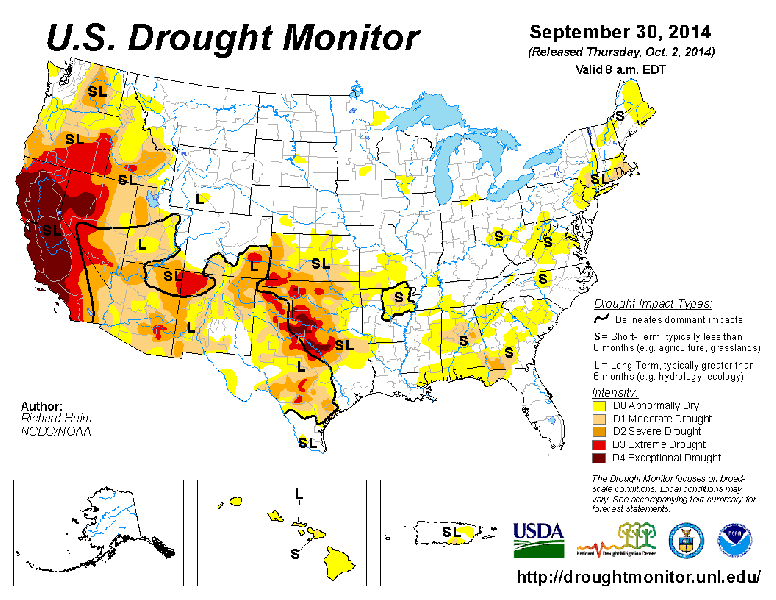

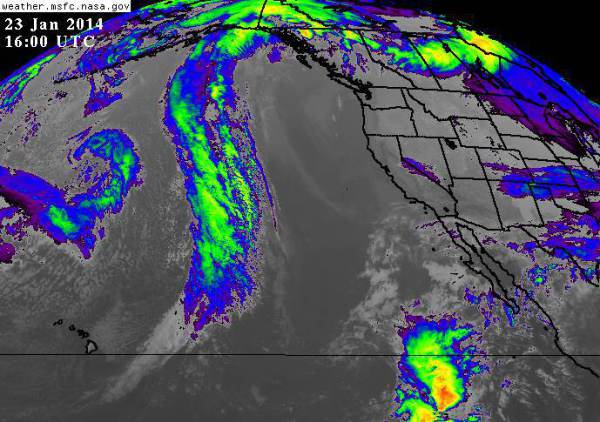

This is an event that is more extreme than any in the observed record, and our research suggests that global warming is playing a role right now. — Stanford Scientist Noah Diffenbaugh **** Last week, a strong storm over-rode a powerful high pressure ridge that has been deflecting moisture-loaded weather systems northward and away from the US West Coast for the better part of two years. Though some precipitation did grace the northern and mountain stretches of the drought-stricken state of California, it is no-where near enough to alleviate an epic 21+ month long drought. A drought borne of a blocking pattern that began during the winter of 2012-2013 and now threatens to extend to the end of 2014 and, possibly, beyond. In the wake of the storm, the powerful ridge reasserted — again delaying hopes that a parched California would at last begin to receive at least a normal allotment of rain. It is a high pressure ridge based blocking pattern that has become so persistent that researchers at Stanford University have given it a new name — the ridiculously resilient ridge or Triple R. And the Triple R, according to those same researchers has climate change based origins. For this week, Stanford scientists published a new study that found: The atmospheric conditions associated with the unprecedented drought currently afflicting California are “very likely” linked to human-caused climate change. Researchers used a combination of climate models and statistical techniques to determine that large, persistent high pressure systems of the kind that have been locking California into perpetual drought are more likely in the presence of high concentrations of greenhouse gasses. They found that the ridge, which has generated year-round wildfires in California and at its peak intensity during January of 2014 stretched from Hawaii all the way to coast of the Arctic Ocean north of Alaska, was a kind of new species of extreme weather far more likely to occur in a human-warmed world. The anomalous strength of the ridge also likely played a role in the powerful polar vortex disruptions that were commonplace throughout the winter of 2014. As the ridge shoved more warm air into the polar zone north of Alaska the cold core of the polar vortex was displaced south and eastward over the Canadian Archipelago and Hudson Bay — driving extreme weather events over the central and eastern US as well as across the Atlantic and on to the UK. The Researchers found that ridging was the overall and anomalous tendency of the pattern in this region of the northeast Pacific. They observed that the ridge remained strong throughout the winter of 2013, weakened during the summer of that year, then flared into an extreme intensity by January of 2014. Since that time, the ridge has swelled and spluttered, occasionally letting a storm or two pass but still serving as a kind of brutal sentinel to weather systems that would typically make their way to California. The results of such a human-caused disruption of the climate are all too visible in the most recent US Drought Monitor. Despite tropical storms and the occasional weakness in the Triple R allowing a brief influx of moisture, 100% of California is still suffering from drought conditions with 58% percent of the state under the most extreme level of drought. Image source: US Drought Monitor) A drought event that is the most extreme in the observed record and that is now linked to climate change by at least three major studies. From the Stanford Study’s authors: “We’ve demonstrated with high statistical confidence that the large-scale atmospheric conditions, similar to those associated with the Triple R, are far more likely to occur now than in the climate before we emitted large amounts of greenhouse gases,” Rajaratnam said. “In using these advanced statistical techniques to combine climate observations with model simulations, we’ve been able to better understand the ongoing drought in California,” Diffenbaugh added. “This isn’t a projection of 100 years in the future. This is an event that is more extreme than any in the observed record, and our research suggests that global warming is playing a role right now.”

Report this post as:

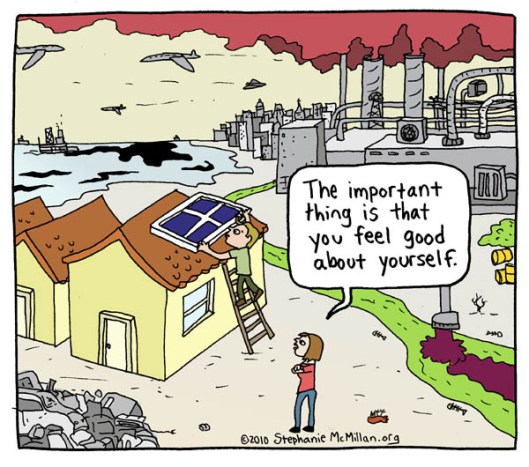

while you career activist BAU shillsby crazy_inventor Friday, Oct. 03, 2014 at 1:38 PM

are posting fossil fool propaganda fluff pieces, your state is turning into a desert right before your head-in-the-sand eyes.

- this is what foundation funded gatekeeping 'left' 'progressive' media has bestowed upon us

Report this post as:

|