| About Us | Contact Us | Calendar | Publish | RSS |

|---|

|

Features • latest news • best of news • syndication • commentary Feature Categories IMC Network:

Original Citieswww.indymedia.org africa: ambazonia canarias estrecho / madiaq kenya nigeria south africa canada: hamilton london, ontario maritimes montreal ontario ottawa quebec thunder bay vancouver victoria windsor winnipeg east asia: burma jakarta japan korea manila qc europe: abruzzo alacant andorra antwerpen armenia athens austria barcelona belarus belgium belgrade bristol brussels bulgaria calabria croatia cyprus emilia-romagna estrecho / madiaq euskal herria galiza germany grenoble hungary ireland istanbul italy la plana liege liguria lille linksunten lombardia london madrid malta marseille nantes napoli netherlands nice northern england norway oost-vlaanderen paris/Île-de-france patras piemonte poland portugal roma romania russia saint-petersburg scotland sverige switzerland thessaloniki torun toscana toulouse ukraine united kingdom valencia latin america: argentina bolivia chiapas chile chile sur cmi brasil colombia ecuador mexico peru puerto rico qollasuyu rosario santiago tijuana uruguay valparaiso venezuela venezuela oceania: adelaide aotearoa brisbane burma darwin jakarta manila melbourne perth qc sydney south asia: india mumbai united states: arizona arkansas asheville atlanta austin baltimore big muddy binghamton boston buffalo charlottesville chicago cleveland colorado columbus dc hawaii houston hudson mohawk kansas city la madison maine miami michigan milwaukee minneapolis/st. paul new hampshire new jersey new mexico new orleans north carolina north texas nyc oklahoma philadelphia pittsburgh portland richmond rochester rogue valley saint louis san diego san francisco san francisco bay area santa barbara santa cruz, ca sarasota seattle tampa bay tennessee urbana-champaign vermont western mass worcester west asia: armenia beirut israel palestine process: fbi/legal updates mailing lists process & imc docs tech volunteer projects: print radio satellite tv video regions: oceania united states topics: biotechSurviving Citieswww.indymedia.org africa: canada: quebec east asia: japan europe: athens barcelona belgium bristol brussels cyprus germany grenoble ireland istanbul lille linksunten nantes netherlands norway portugal united kingdom latin america: argentina cmi brasil rosario oceania: aotearoa united states: austin big muddy binghamton boston chicago columbus la michigan nyc portland rochester saint louis san diego san francisco bay area santa cruz, ca tennessee urbana-champaign worcester west asia: palestine process: fbi/legal updates process & imc docs projects: radio satellite tv |

printable version

- js reader version

- view hidden posts

- tags and related articles

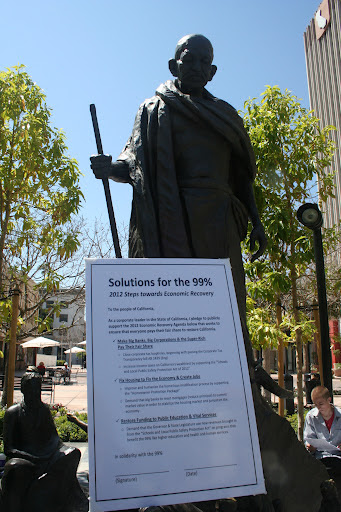

View article without comments Group of Six shutdown Wells Fargoby the lizard queen Monday, Apr. 16, 2012 at 6:09 PMtolerance2day@ymail.com April 10th was a warm sunny Tuesday and exceptionally busy in downtown riverside. Walking through the main st. mall adjacent to the mission inn with men and woman in suits meeting for business lunches all seemed to be normal. However Refund California Coalition an economic justice organization, paired with group of UCR students and Occupy Riverside organizers, began to setup signs and a microphone with the Gandhi statue overlooking. People in the mall began to turn their heads in curiosity, the conversation had started.

It was noon when the organizers began to speak out about the Home Foreclosure crises that has affected so many not only in the riverside area, but the nation. Yet riverside having the highest rate of foreclosures in California it wasn't a surprise that many in the group had touching stories to tell of their own life experiences.

J. a UCR student shared his story about his father being coerced into taking out a $850,000 home loan from someone he had known, someone his father had gone to church with. His father a 45 year old iron worker with realistically only 15 to 20 more years of work before the intense labor would take its toll and he would have to retire. The house was inevitably foreclosed on around the same time J. was awaiting his acceptance to UCR.

“It was horrible getting my acceptance letter and watching my mom pack up the house, wanting to give me the best but knowing she was powerless to provide any of it for me.” J. said as the crowd consisting of a few men in business attire and a young mother with her infant child, as well as the many lunchtime onlookers from the various eateries in the area, were nodding their head in understanding agreement. Next up was a young community college professor with her PhD in English and a single mother. She shared not only her experience of being laid off at UCR where she had received teacher of the year and worked for ten years as an outcome of the economic crash that this foreclosure crises had caused, but of how the housing bubble both boomed and burst . “The yearly contracts that all the instructors received were rescinded.” She explained that the instructors health benefits were gone and they were left to fend for themselves in the academic job market that due to budget cuts is not secure and only part time work is available.

She went on to discuss the housing bubble and how it came to be. “The banks ran out of people who could afford to buy homes and so new innovations were created such as the sub-prime loans, they didn't have to verify budget or source of income of the people looking to buy homes, basically the banks had no sort of accountability in falsely telling these people that they could afford these loans because it would make the bank more money...they were treating someones debt as an asset.” As she began talking about Collateral Debt Obligations or CDOs two Riverside Police officers appeared on bikes. Officer Dillon one of the officers that protesters and organizers of Occupy Riverside interact with on a regular basis asked her to stop as she wasn't allowed to use the microphone or any sort of sound projecting device. Already being familiar with this type of harassment the woman politely put up her hand and stated she was almost done they would just have to wait a moment. “These people want me to finish it up.”

She finished her speech and without the use of the microphone a couple of others spoke to the tragic state of the higher education system. As the speeches ended the signs were gathered and letters were passed out to the participants who were now heading to Wells Fargo on the corner of Main st. and University.

The group of six went inside the main lobby signs and all asking to speak to the bank manager. The bank manager Samuel L. Robles who appeared in a suit, a tie and a little flustered shook the hands of everyone in the discussion circle and proceeded to answer questions.

“We would like for you to take a look at this letter and to distribute it to the higher ups” Elliot of Refund California asked confidently. “I would love to take a look at that absolutely and I just want to let you know that we do donate to the community.” Robles said almost in a memorized sort of tone. The questions continued. “What's your relationship to the sub-prime loans?” The young professor asked with concern. His only answer being “We don't do mortgages here at this branch.” After which he excused himself for a moment and whispered something to a female employee who then locked the doors leading into the main lobby as customers were walking up. One of the occupy Riverside participants asked “Why are you refusing service to your customers?” Robles chuckled and stated that he wasn't refusing service he was protecting his customers from dangerous radicals. “You think we're dangerous?” one of the students asked with a serious tone. “No but I have to protect my customers, you never know what could happen.” he nervously answered. One of the young women in the group answering “Well they probably aren't going to want to come back.”

The questions returned to the home foreclosure crises as the group now being held captive in the bank nervously looked around. “What are you doing to fix the crises you have created?” “Wells Fargo holds nationwide mortgage clinics and donates money to Ronald McDonald House.” Unsure of how that related to the housing crises the group wrapped up the meeting and were escorted out.

Report this post as:

Fraud?by homeowner1 Tuesday, Apr. 17, 2012 at 4:07 AMmaybe if people paid their morgages and didn't take out loans they knew they couldn't afford they wouldn't get foreclosed on its that simple folks cmon seriously if anyone is lying its the idiots who walk into the bank and think they can afford a house on $8 an hour wow this author is spouting some leftist propaganda for sure.

Report this post as:

Thanks, bank...by reader Tuesday, Apr. 17, 2012 at 10:07 PM...but we don't really need your comments here. Fortunately, the readers on this site are smart enough to recognize bank propaganda when they see it, but just in case anyone is swayed:

"Bad choices" by isolated individuals does not a crisis make. It's like the speaker points out, banks created ways to make more money and paid to prevent policymakers from regulating them. Which is why in order to survive this crisis we need to create change within the very structures of the economic system, which Occupy is leading the way in doing. Your days of paying people to comment on articles to improve your image, just like your days of stealing homes and ripping people off to accumulate our wealth, are numbered.

Report this post as:

Reality checkby nobody Wednesday, May. 02, 2012 at 6:59 AMMost people buying houses rely on their real estate agent and the bank to put together the financial stuff. Think about it. What regular person can do that stuff? We can't. Even those of us with the ability to do so, can't, because the bank has the money.

Report this post as:

|