| About Us | Contact Us | Calendar | Publish | RSS |

|---|

|

Features • latest news • best of news • syndication • commentary Feature Categories IMC Network:

Original Citieswww.indymedia.org africa: ambazonia canarias estrecho / madiaq kenya nigeria south africa canada: hamilton london, ontario maritimes montreal ontario ottawa quebec thunder bay vancouver victoria windsor winnipeg east asia: burma jakarta japan korea manila qc europe: abruzzo alacant andorra antwerpen armenia athens austria barcelona belarus belgium belgrade bristol brussels bulgaria calabria croatia cyprus emilia-romagna estrecho / madiaq euskal herria galiza germany grenoble hungary ireland istanbul italy la plana liege liguria lille linksunten lombardia london madrid malta marseille nantes napoli netherlands nice northern england norway oost-vlaanderen paris/Île-de-france patras piemonte poland portugal roma romania russia saint-petersburg scotland sverige switzerland thessaloniki torun toscana toulouse ukraine united kingdom valencia latin america: argentina bolivia chiapas chile chile sur cmi brasil colombia ecuador mexico peru puerto rico qollasuyu rosario santiago tijuana uruguay valparaiso venezuela venezuela oceania: adelaide aotearoa brisbane burma darwin jakarta manila melbourne perth qc sydney south asia: india mumbai united states: arizona arkansas asheville atlanta austin baltimore big muddy binghamton boston buffalo charlottesville chicago cleveland colorado columbus dc hawaii houston hudson mohawk kansas city la madison maine miami michigan milwaukee minneapolis/st. paul new hampshire new jersey new mexico new orleans north carolina north texas nyc oklahoma philadelphia pittsburgh portland richmond rochester rogue valley saint louis san diego san francisco san francisco bay area santa barbara santa cruz, ca sarasota seattle tampa bay tennessee urbana-champaign vermont western mass worcester west asia: armenia beirut israel palestine process: fbi/legal updates mailing lists process & imc docs tech volunteer projects: print radio satellite tv video regions: oceania united states topics: biotechSurviving Citieswww.indymedia.org africa: canada: quebec east asia: japan europe: athens barcelona belgium bristol brussels cyprus germany grenoble ireland istanbul lille linksunten nantes netherlands norway portugal united kingdom latin america: argentina cmi brasil rosario oceania: aotearoa united states: austin big muddy binghamton boston chicago columbus la michigan nyc portland rochester saint louis san diego san francisco bay area santa cruz, ca tennessee urbana-champaign worcester west asia: palestine process: fbi/legal updates process & imc docs projects: radio satellite tv |

printable version

- js reader version

- view hidden posts

- tags and related articles

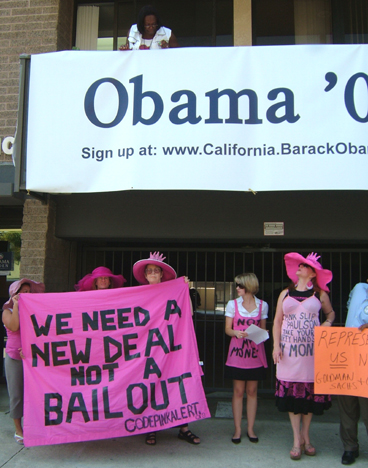

View article without comments No Wall Street Bailout Protesters Picket at Obama LA Officeby A Thursday, Oct. 02, 2008 at 2:26 PMLOS ANGELES, October 1, 2008 – A small demonstration was held outside the Los Angeles Obama campaign office today to protest Obama’s support for the Bush’s Wall Street bailout bill.

The protest initiated by Code Pink Women for Peace did receive some local corporate media coverage. KTLA TV and KFWB radio did interview some of the protesters. (It is unknown if they will broadcast the event or if these corporate media outlets can be relied upon to correctly represent the demonstrator’s message.)

Report this post as:

Staffer looks down at protestby A Thursday, Oct. 02, 2008 at 2:26 PM

Obama LA Headquarters, 3619 Motor Ave., Los Angeles, CA 90034

Report this post as:

KTLA interviewby A Thursday, Oct. 02, 2008 at 2:26 PM

error

Report this post as:

KFWB interviewby A Thursday, Oct. 02, 2008 at 2:26 PM

error

Report this post as:

Bailout or No, we're screwedby screwdriver Thursday, Oct. 02, 2008 at 9:11 PMThe MBSs were backed up by CDSs and other exotic derivatives.

The right wingers started out by blaming the borrowers for borrowing too much. The liberals said the people selling the mortgages were to blame. Who's really at fault though? These derivatives were created to reduce risk, and everyone thought they would reduce risk. In fact, they created a huge volume of trading that quickly created a new layer of the economy. There was your growth in the GDP. Somehow, you can move factories away, have people stuck in low-pay service jobs, and still grow the GDP, as long as there's a new layer of the economy that's based on trading money and writing contracts. So, now that strata of the market is collapsing. But the problem is, banks invested in this fraudulent market. Pension funds invested in it. Regular people even bought into it. So, many people will lose a lot of money. It is time to enumerate our real needs, and figure out how to meet them. We all need food, housing, clothing, education, transportation, a phone, and probably the internet. Let's "socialize" these needs, and make it possible for everyone to have their basic needs met. Then it won't matter if the stock portfolio goes up in flames.

Report this post as:

Internetby screwdriver Saturday, Oct. 04, 2008 at 11:18 PMIt's too bad Prion Party's post is hidden.

Universalizing internet would be a potential way to soften the blow of this coming crash. The cost of extending internet to everyone would probably be modest. You just need to define "universal access" flexibly, to include dial-up access and low-speed radio. In urban areas, mandate that all people within a company's range be sold product that has a reasonable level of reliability. Then, once the standards are set, force companies in the cities to comply. The hardware upgrades alone would create jobs and raise revenues. These could even be American companies and workers benfitting. Also, you could mandate that all apartments offer some kind of apartment-wide internet. This would create an apartment-specific market for small routers. Boom, instantly, you have a few thousand jobs over the next five years or so. The internet, like the phone, is a technology that creates economic effects that go well beyond the phone.

Report this post as:

|