| About Us | Contact Us | Calendar | Publish | RSS |

|---|

|

Features • latest news • best of news • syndication • commentary Feature Categories IMC Network:

Original Citieswww.indymedia.org africa: ambazonia canarias estrecho / madiaq kenya nigeria south africa canada: hamilton london, ontario maritimes montreal ontario ottawa quebec thunder bay vancouver victoria windsor winnipeg east asia: burma jakarta japan korea manila qc europe: abruzzo alacant andorra antwerpen armenia athens austria barcelona belarus belgium belgrade bristol brussels bulgaria calabria croatia cyprus emilia-romagna estrecho / madiaq euskal herria galiza germany grenoble hungary ireland istanbul italy la plana liege liguria lille linksunten lombardia london madrid malta marseille nantes napoli netherlands nice northern england norway oost-vlaanderen paris/Île-de-france patras piemonte poland portugal roma romania russia saint-petersburg scotland sverige switzerland thessaloniki torun toscana toulouse ukraine united kingdom valencia latin america: argentina bolivia chiapas chile chile sur cmi brasil colombia ecuador mexico peru puerto rico qollasuyu rosario santiago tijuana uruguay valparaiso venezuela venezuela oceania: adelaide aotearoa brisbane burma darwin jakarta manila melbourne perth qc sydney south asia: india mumbai united states: arizona arkansas asheville atlanta austin baltimore big muddy binghamton boston buffalo charlottesville chicago cleveland colorado columbus dc hawaii houston hudson mohawk kansas city la madison maine miami michigan milwaukee minneapolis/st. paul new hampshire new jersey new mexico new orleans north carolina north texas nyc oklahoma philadelphia pittsburgh portland richmond rochester rogue valley saint louis san diego san francisco san francisco bay area santa barbara santa cruz, ca sarasota seattle tampa bay tennessee urbana-champaign vermont western mass worcester west asia: armenia beirut israel palestine process: fbi/legal updates mailing lists process & imc docs tech volunteer projects: print radio satellite tv video regions: oceania united states topics: biotechSurviving Citieswww.indymedia.org africa: canada: quebec east asia: japan europe: athens barcelona belgium bristol brussels cyprus germany grenoble ireland istanbul lille linksunten nantes netherlands norway portugal united kingdom latin america: argentina cmi brasil rosario oceania: aotearoa united states: austin big muddy binghamton boston chicago columbus la michigan nyc portland rochester saint louis san diego san francisco bay area santa cruz, ca tennessee urbana-champaign worcester west asia: palestine process: fbi/legal updates process & imc docs projects: radio satellite tv |

printable version

- js reader version

- view hidden posts

- tags and related articles

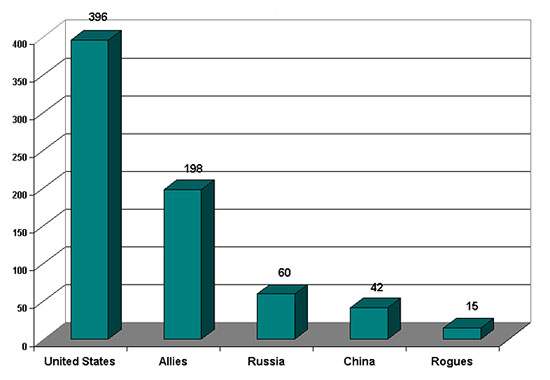

View article without comments Freeloaders Abound!by Simple Simon Monday, Jan. 06, 2003 at 1:32 AMA brief look at who is paying taxes On October 24 the Joint Economic Committee released the latest IRS data for 2000. Here’s the table:

Report this post as:

That's the real deal Simonby Bush Admirer Monday, Jan. 06, 2003 at 1:56 AMWhat we get from the left is whining and complaining without justification. They aren't the ones pulling the wagon. They're riding in the wagon while bitching and moaning all the way.

Report this post as:

Or thats also common senseby realist Monday, Jan. 06, 2003 at 8:11 AMIf their rich, they have more money. They have more to be taxed.

Report this post as:

what about those who are freeby David Arthur Johnston Monday, Jan. 06, 2003 at 3:50 PMHatrackman@yahoo.com and use no money- does a person have the right to not use money? www.angelfire.com/apes/hatrackman

Report this post as:

and for those on the bottom?by Marc Tuesday, Jan. 07, 2003 at 8:48 PMWhat is the proportion of taxes paid by those on the bottom (say, under ,000 per anum.)? Include such lofty issues as payroll taxes, gasoline taxes, taxes on sundries (all the shit you wear, sleep on, and use to make your cubicle-apartment look less boring), taxes on consumibles (not liquor - but virtually everything you buy at the grocery store), etc., etc. What then is the proportion of taxes paid by those "lazy do-nothings" who try to eke out a living vs. the actual take-home pay they have AFTER all those "hidden" but oh-so-burdonsome taxes are included? Just curious, but i think it's pretty apparent that those on the bottom see a great deal of their hard-earned money disappear rather quickly through taxes other than those directly assessed by Uncle Sam April 15.

Report this post as:

Simpleby Simple Simon Tuesday, Jan. 07, 2003 at 9:06 PMIrrelevant, Marc. We all have to pay the regressive taxes which don’t take into account our ability to pay them. If I buy a Snickers bar it will cost me the same as it would cost Bill Gates. If Mr. Gates and I have the same appetite for Snickers bars over the course of a year, we will pay the same amount in taxes. Come April 15th, however, Mr. Gates will be paying MILLIONS of dollars, while I will pay a couple of hundred, or perhaps even get a couple of hundred back. Your hard-scrabble friends don’t pay a cent in income taxes, and their contributions through the year towards other taxes are a tear in a salted sea when compared to the taxes paid by the wealthy.

Report this post as:

nice chartby realist Tuesday, Jan. 07, 2003 at 10:17 PMNice chart (seriously, its informative.)

Report this post as:

Thanks B.A.by Marc Tuesday, Jan. 07, 2003 at 11:10 PMThat's actually a sunstantive and informative display of information. And to S.S., I didn't mean to infer that somehow the burden was more for people lower on the scale, only that proportionately, they have less money to spare, and those nickles (and dimes, and quarters, etc.) add up real quick. I myself am not a Democrat, nor Republican, and actually see it as quite ludicrous that we tax the rich more based on what they make. This gets me out of favor with a lot of folk that i agree with on almost every other social issue, but it seems to penalize people for making more money. There are other (valid) ways to assess taxes. I would be more in favor of some nominal "citizen" tax. A flat tax actually would be detrimental, but there should be a more practical and sensible approach to taxation. Just to pick one, the Federal income Tax was intended to bulk up the War Chest for WWII, but after realizing the cash cow in hand, the government renegged on their promise. I'm not in favor of removing this tax (as there are good purposes for them), but unfortunately there is so much pork going around (not just Defence contractors - though they are the prime offenders) that the real things that should be taken to the utmost in a civilized society (yes, universal healthcare, and first-notch education should be in the top three) are left wanting, or begging for scraps as other budgets increase.

Report this post as:

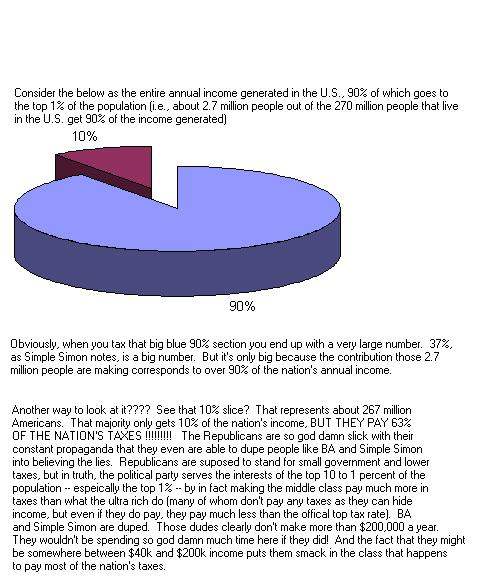

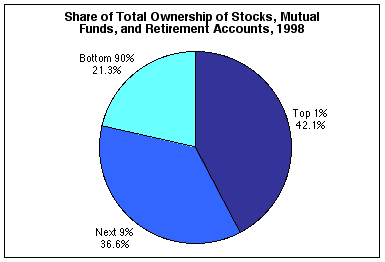

yawnby fucked up math Wednesday, Jan. 08, 2003 at 8:50 AMSimple Simon shows his simple logic and comprehension -- once again. The top 1% of the income earners in the United States reap over 90% of the income produced in the United States. Taxing that income at 10 or 20 percent overall, after factoring the various shelters these ultra rich make use of, results in the ~37% figure quoted. There's no freeloading going on here, just a distortion of statistics achieved by how one frames those statistics.

Report this post as:

Math test at 3pm classby math Wednesday, Jan. 08, 2003 at 9:22 AM

Math test at 3pm class

Report this post as:

more mathby more math Wednesday, Jan. 08, 2003 at 9:34 AMOne of the other ways the math on all these issues gets fucked up is the fact that there's no real accounting effort made for anyone in that 1%-on-up section of the population. In any event, Bush Admirer and Simple Simon will continue to be confused. Bush Admirer definitely gets one thing correct above, however. Everyone indeed gets screwed. But maybe one of theses days the guy will stop spending so god damn much time entertaining himself with attacks on leftists and more time just looking at the raw numbers, raw information. I'm not a raving leftist. There's some good qualities about capitalism. But there are real problems too.

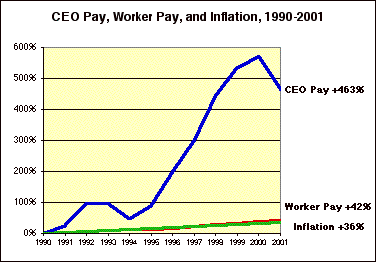

The Super Rich Are Out of Sight by Michael Parenti http://www.commondreams.org/views02/1227-06.htm The super rich, the less than 1 percent of the population who own the lion's share of the nation's wealth, go uncounted in most income distribution reports. Even those who purport to study the question regularly overlook the very wealthiest among us. For instance, the Center on Budget and Policy Priorities, relying on the latest U.S. Census Bureau data, released a report in December 1997 showing that in the last two decades "incomes of the richest fifth increased by 30 percent or nearly ,000 after adjusting for inflation." The average income of the top 20 percent was 7,500, or almost 13 times larger than the ,250 average income of the poorest 20 percent. But where are the super rich? An average of 7,500 is an upper-middle income, not at all representative of a rich cohort, let alone a super rich one. All such reports about income distribution are based on U.S. Census Bureau surveys that regularly leave Big Money out of the picture. A few phone calls to the Census Bureau in Washington D.C. revealed that for years the bureau never interviewed anyone who had an income higher than 0,000. Or if interviewed, they were never recorded as above the "reportable upper limit" of 0,000, the top figure allowed by the bureau's computer program. In 1994, the bureau lifted the upper limit to million. This still excludes the very richest who own the lion's share of the wealth, the hundreds of billionaires and thousands of multimillionaires who make many times more than million a year. The super rich simply have been computerized out of the picture. When asked why this procedure was used, an official said that the Census Bureau's computers could not handle higher amounts. A most improbable excuse, since once the bureau decided to raise the upper limit from 0,000 to million it did so without any difficulty, and it could do so again. Another reason the official gave was "confidentiality." Given place coordinates, someone with a very high income might be identified. Furthermore, he said, high-income respondents usually understate their investment returns by about 40 to 50 percent. Finally, the official argued that since the super rich are so few, they are not likely to show up in a national sample. But by designating the (decapitated) top 20 percent of the entire nation as the "richest" quintile, the Census Bureau is including millions of people who make as little as ,000. If you make over 0,000, you are in the top 4 percent. Now 0,000 is a tidy sum indeed, but it's not super rich--as in Mellon, Morgan, or Murdock. The difference between Michael Eisner, Disney CEO who pocketed 5 million in 1996, and the individuals who average ,250 is not 13 to 1--the reported spread between highest and lowest quintiles--but over 61,000 to 1. Speaking of CEOs, much attention has been given to the top corporate managers who rake in tens of millions of dollars annually in salaries and perks. But little is said about the tens of billions that these same corporations distribute to the top investor class each year, again that invisible fraction of 1 percent of the population. Media publicity that focuses exclusively on a handful of greedy top executives conveniently avoids any exposure of the super rich as a class. In fact, reining in the CEOs who cut into the corporate take would well serve the big shareholder's interests. Two studies that do their best to muddy our understanding of wealth, conducted respectively by the Rand Corporation and the Brookings Institution and widely reported in the major media, found that individuals typically become rich not from inheritance but by maintaining their health and working hard. Most of their savings comes from their earnings and has nothing to do with inherited family wealth, the researchers would have us believe. In typical social-science fashion, they prefigured their findings by limiting the scope of their data. Both studies failed to note that achieving a high income is itself in large part due to inherited advantages. Those coming from upper-strata households have a far better opportunity to maintain their health and develop their performance, attend superior schools, and achieve the advanced professional training, contacts, and influence needed to land the higher paying positions. More importantly, both the Rand and Brookings studies fail to include the super rich, those who sit on immense and largely inherited fortunes. Instead, the investigators concentrate on upper-middle-class professionals and managers, most of whom earn in the 0,000 to 0,000 range--which indicates that the researchers have no idea how rich the very rich really are. When pressed on this point, they explain that there is a shortage of data on the very rich. Being such a tiny percentage, "they're an extremely difficult part of the population to survey," pleads Rand economist James P. Smith, offering the same excuse given by the Census Bureau officials. That Smith finds the super rich difficult to survey should not cause us to overlook the fact that their existence refutes his findings about self-earned wealth. He seems to admit as much when he says, "This [study] shouldn't be taken as a statement that the Rockefellers didn't give to their kids and the Kennedys didn't give to their kids." (New York Times, July 7, 1995) Indeed, most of the really big money is inherited--and by a portion of the population that is so minuscule as to be judged statistically inaccessible. The higher one goes up the income scale, the greater the rate of capital accumulation. Economist Paul Krugman notes that not only have the top 20 percent grown more affluent compared with everyone below, the top 5 percent have grown richer compared with the next 15 percent. The top one percent have become richer compared with the next 4 percent. And the top 0.25 percent have grown richer than the next 0.75 percent. That top 0.25 owns more wealth than the other 99¾ percent combined. It has been estimated that if children's play blocks represented 00 each, over 98 percent of us would have incomes represented by piles of blocks that went not more than a few yards off the ground, while the top one percent would stack many times higher than the Eiffel Tower. Marx's prediction about the growing gap between rich and poor still haunts the land--and the entire planet. The growing concentration of wealth creates still more poverty. As some few get ever richer, more people fall deeper into destitution, finding it increasingly difficult to emerge from it. The same pattern holds throughout much of the world. For years now, as the wealth of the few has been growing, the number of poor has been increasing at a faster rate than the earth's population. A rising tide sinks many boats. To grasp the true extent of wealth and income inequality in the United States, we should stop treating the "top quintile"--the upper-middle class--as the "richest" cohort in the country. But to do that, we need to look beyond the Census Bureau's cooked statistics. We need to catch sight of that tiny, stratospheric apex that owns most of the world. Michael Parenti is a noted author and political commentator. Among his widely read books are "The Terrorism Trap," "Democracy For the Few," "History as Mystery," and "Against Empire." His most recent forthcoming book is "The Assassination of Julius Caesar: A People's History of Ancient Rome." For more information, visit his web site, www.michaelparenti.org.

Report this post as:

Simpleby Simple Simon Wednesday, Jan. 08, 2003 at 4:37 PMMath is so full of crap. Why bother with your rediculous premise, Math? My statistics come directly from the IRS. Yours from your pea brain. Why not go for the whole enchilada? Next time say that the top three families of the Republican Party get 99% of all income generated and all the rest of America lives on sucking the dew out of old gym socks left on the grass. Your math is a joke.

Report this post as:

thanks 'math'....by lynx-11 Friday, Jan. 10, 2003 at 5:54 AM

Report this post as:

thanks 'more math'.....by lynx-11 Friday, Jan. 10, 2003 at 6:46 AMDiscretionary Spending Under the Proposed Bush Administration Budget for FY2003 a lot of nice charts try this see also: old but interesting network of links ------------------------------------------------------------------------------------- anticrisis

Report this post as:

Simpleby Simple Simon Friday, Jan. 10, 2003 at 4:54 PMThere are times, Link, when I think you are just pulling my leg. There is no way you can trot out crap like this, let it fester under the sun and tell me you actually believe it.

Report this post as:

pop quizby .. Saturday, Jan. 11, 2003 at 12:00 AM

"We have some people riding in the wagon and some people pulling the wagon.... The richest Americans do most of the pulling."

Report this post as:

Simpleby Simple Simon Saturday, Jan. 11, 2003 at 12:11 AMYour post was incomplete. The proper answer is of course F: The Truth. Nice picture though.

Report this post as:

uhhby Marc Saturday, Jan. 11, 2003 at 12:12 AMUnless they single-handedly manufacture and produce something, they are making their money off the labors of others.

Report this post as:

Laborby Marc Saturday, Jan. 11, 2003 at 12:38 AMLabor is a commodity that you can buy in the open market. You're buying labor when you hire a yard man or have your car repaired.

Report this post as:

Labor painsby 48 Saturday, Jan. 11, 2003 at 3:02 AMMarc said: " let's suppose that your yard man starts marching back and forth in front of your house with a sign protesting against Marc for exploiting the poor. Solution: Hire a different yard man. "

Report this post as:

Robot Slave #48by Garaj Dohr Saturday, Jan. 11, 2003 at 3:39 AM--> What happens if ALL the yard men, sick of being exploited, band together and ALL picket in front of Marc's house?

Report this post as:

Sorryby Marc Saturday, Jan. 11, 2003 at 5:00 PMI hate to burst anyone's bubble, but the first post ("uhh") was mine, the second ("labor") was not. Someone's obviously insecure enough in their own opinions not to take ownership and accountability for them. As such, I won't accomodate their insecurity with a retort.

Report this post as:

Also,by Marc Saturday, Jan. 11, 2003 at 5:10 PMGaraj Dohr, the following quote from your post...

Report this post as:

Simpleby Simple Simon Saturday, Jan. 11, 2003 at 5:23 PMMarc, you're going to have to get used to people stealing your nickname (or nick) around here. It's part of the game.

Report this post as:

Yes, butby Marc Saturday, Jan. 11, 2003 at 5:41 PMNothing you said is factually incorrect. But the employer must accumulate their wealth/property/money somewhere to begin with, be it by their own labors, inheritance, dicovery, invention, etc. That is a component of the mix that must be ackowledged, but not the only one. I was disagreeing more with the premise of be a boss and hire people. If everyone is a boss, there are no workers. That is not feasible.

Report this post as:

Simpleby Simple Simon Saturday, Jan. 11, 2003 at 6:24 PMMarc, obviously we cannot all be the 'boss', but then most of us don't want to be. Different people will make the decision whether or not to strike out on their own based upon the balancing of potential rewards vs. risk. The fact is that most people are content trading their labor for cash and security, and are pleased that they only have to worry about their one small part of an enterprise. They are not risk takers. The class of people you refer to as 'bosses' are less adverse to risk. They are willing to forego the security of a paycheck and benefits provided by a company (or the government), because they beleive that their idea can work and will generate a profit for them.

Report this post as:

Yes, Simonby Marc Saturday, Jan. 11, 2003 at 6:34 PMYes, but i'm not arguing that. I respect the ability of people to take risks and try to prosper. I'm only throwing out the reality that that does not, and can not apply to the majority of people. It is far easier to risk when you can afford to lose a lot. When you can not afford to lose anything, that is a massive risk. And, again, those that do risk, are risking something (other than just their reputation) that was ammassed somewhere prior to their taking the risk in the first place. I'm only arguing the notion that those that provide the labor are actual workers and should not be classified as "lazy, do-nothing, non-risk taking" people that would otherwise be waiting in welfare lines. That's elitist and classist.

Report this post as:

Simpleby Simple Simon Saturday, Jan. 11, 2003 at 7:18 PMMarc, my original purpose in posting was to dispel the fantasy that 'the poor' are somehow shouldering the burden of paying the taxes in this country and 'the rich' are getting off scott free. This is the cock and bull story repeated ad nauseum by the Demogogues of the Democratic Party in this country. The fact is just the opposite - 'the rich' pay the vast majority of the taxes, while 'the poor' get off scott free - and enjoy the largesse of the government which is provided by these taxes. If you're poor enough you receive free medical care, free food, free housing, free job training, free job placement, free drug and alcohol counseling, etc... not one penny of which has been payed for by 'the poor'.

Report this post as:

In some agreementby Marc Saturday, Jan. 11, 2003 at 7:33 PMFor the most part, yes, Simon. But I also have strong reservations aobut the income tax, in general. That doesn't sit well with most people, but it seems counterintuitive to penalize people for making more money, and it creates the impression . I would prefer we have some sort of individual citizen tax, a legal residency tax for immigrants who are not citizens (yet), better controlled tariffs (although we have marginalized this by allowing so many US corporations to headquarters outside the US), tolls, sales taxes on durable goods we all must buy, remove the gluttony and pork in government (both major parties are prime offenders), make elected representatives salaries representative of their constituency, reaffirm that government's role is for the people (remove profiteering from government), so it's aim should be to direct its services for as broad and maximum representation of the populace as possible.

Report this post as:

Simpleby Simple Simon Saturday, Jan. 11, 2003 at 8:54 PMAn excellent proposition. The idea of getting rid the income tax would stimulate the economy greatly. The increased wealth of the general public would be invested, spent or used to create businesses which could then be taxed to make sure essential services are still provided by the government. Fat chance of anything like this occuring, however. We cannot even get the concept of a flat tax passed.

Report this post as:

Flat taxby Marc Saturday, Jan. 11, 2003 at 9:23 PMI don't know that that is really a better idea, although it may be simpler to codify than the existing lexicon of tax code. I think the personal income tax codes should be condensed to at most 10 pages. The amount of legaleze and jargon contained within it only substantiates the dearth of tax consultants and attorneys.

Report this post as:

.by lynx-11 Sunday, Jan. 12, 2003 at 12:59 AMrocket science?

up ------------------------------------------------------------------------------------------------ anticrisis

Report this post as:

Simpleby Simple Simon Tuesday, Jan. 14, 2003 at 4:42 AMBrilliant analysis, again, Link. You found data from that all-so-reliable and world-renowned economics powerhouse, the war resisters league. Oh, you're good.

Report this post as:

Facts according to whom?by Sterling Edward Tuesday, Jan. 14, 2003 at 6:27 AMMr. Simon,

Report this post as:

Simpleby Simple Simon Tuesday, Jan. 14, 2003 at 9:06 PMWonderful analysis. You will doubt the IRS' figures of what is spent on what in the government, yet will give full credence to a "league" which purports to know exactly how our tax dollars are spent.

Report this post as:

thanks 'Sterling Edward'.....by lynx-11 Wednesday, Jan. 15, 2003 at 9:42 PM'fresca' says we should read carefully....

Report this post as:

Simpleby Simple Simon Wednesday, Jan. 15, 2003 at 11:45 PMGood Stuff. To get to their goal of portraying the budget as being predominantly spent on the military they just remove stuff like payments to Social Security. Wow. That's a helluva argument. Hell, if you can just take anything out of the budget to make the balance more militarily preponderant, then why not go all the way? We are spending 100% of our budget on the military if you don't count anything else we spend money on. The 'war resisters league' are a collection of nincompoops, but keep coming back, Link.

Report this post as:

.by lynx-11 Thursday, Jan. 16, 2003 at 5:18 AMfunds such as Social Security... are raised and spent separately from income taxes. What you pay (or don’t pay) by April 15, 2002, goes only to the federal funds portion of the budget. The government practice of combining trust and federal funds (the so-called “Unified Budget”) began in the 1960s during the Vietnam War. The government presentation makes the human needs portion of the budget seem larger and the military portion smaller.

another nice chart another couple nice charts who pulls the (war) wagon? more -------------------------------------------------------------------------------------------------- anticrisis

Report this post as:

Simpleby Simple Simon Thursday, Jan. 16, 2003 at 6:27 AMWell Ms. Link, it would seem you've hoisted yourself on your own petard. When conducting your tedious linkings, it would behoove you to ensure that they are not contradictory.

Report this post as:

.by lynx-11 Saturday, Jan. 18, 2003 at 5:13 AMWhy Do the Percentages Vary from Group to Group? (see yellow box)

another nice chart 'Simple Simon's favorite chart who pulls the (war) wagon? more -------------------------------------------------------------------------------------------------- anticrisis

Report this post as:

and moreby Marc Saturday, Jan. 18, 2003 at 4:29 PM

Report this post as:

Simpleby Simple Simon Saturday, Jan. 18, 2003 at 5:17 PMRegardless of your endless and conflicting attempts at disinformation, the fact remains that the 'rich' pay a disproportionate preponderance of the taxes in this country, and the 'poor' don't pay squat.

Report this post as:

Bush Admirer is Simple Simonby Bored Saturday, Jan. 18, 2003 at 5:26 PMOne person posing as two.

Report this post as:

OneEyedManby KPC Saturday, Jan. 18, 2003 at 7:54 PMNo, they're not the same person, they're just locked in such a tight circle-jerk that the seem like one person

Report this post as:

OneEyedManby KPC Saturday, Jan. 18, 2003 at 7:58 PM...the question isn't who pays more taxes, but who gets more out of the taxes paid.....certainly ain't the fuckin' poor, or they wouldn't BE poor....the rich reap a disproportionate amount of benefits, THAT is a fact. Take, take, take, then cry like a fuckin' baby when it's time to ante up their share...typical Republicanism bullshit....

Report this post as:

Simpleby Simple Simon Saturday, Jan. 18, 2003 at 9:28 PMWell, KPC, since you've opened your fool mouth again, why don't you put up or shut up?

Report this post as:

.by lynx-11 Saturday, Jan. 18, 2003 at 11:08 PM"benefits that the rich receive"

Report this post as:

Simpleby Simple Simon Sunday, Jan. 19, 2003 at 12:05 AMYou are so easy to beat up, Link, I'm starting to feel sorry for you.

Report this post as:

Thank you Simonby B.A. Sunday, Jan. 19, 2003 at 4:02 AMThe only reason Lynx posts is to kill the thread. The Lynx signature is a signal that there's no point in reading this post. It's just going to be a link, or a collection of links, to a far left radical web site w/o any discussion or arguments.

Report this post as:

.by lynx-11 Thursday, Jan. 23, 2003 at 12:03 AM"far left radical web site"....????!! (check upper left corner link) more more info on who benefits and more ----------------------------------------------------------------------------- anticrisis

Report this post as:

we wastedby baby Thursday, Jan. 23, 2003 at 12:08 AM

“Had we, as an Air Force, managed the C-17 (Globemaster III) program…in a steady, consistent manner, we would have saved close to billion,” Secretary of the Air Force, Roche, said at the Air and Space Seminar on Capitol Hill.

Report this post as:

Simpleby Simple Simon Thursday, Jan. 23, 2003 at 4:24 PMEarth to Link, Come in Link.

Report this post as:

OneEyedManby KPC Thursday, Jan. 23, 2003 at 5:42 PMPvt. Fido, must you continually lick yourself on-line, it's fuckin' embarrassing!

Report this post as:

Simpleby Simple Simon Thursday, Jan. 23, 2003 at 6:54 PMHey, you are still here, KPC. So where's my list? You remember, don't you?

Report this post as:

OneEyedManby KPC Thursday, Jan. 23, 2003 at 7:12 PMgoooood doggie....gooooooood boy...now, roll over! ROLLLLLL OVER!

Report this post as:

UNDERSTANDING TAX LAWby Bush Admirer Thursday, Jan. 23, 2003 at 9:28 PMThis is a VERY simple way to understand the tax laws. Read on - it does make you think!!

Report this post as:

..by baby Thursday, Jan. 23, 2003 at 11:23 PM

Report this post as:

"From the boss down to the guy sweeping the floors after hours...."by baby Thursday, Jan. 23, 2003 at 11:39 PM

Report this post as:

..by baby Thursday, Jan. 23, 2003 at 11:45 PM

Report this post as:

Simpleby Simple Simon Friday, Jan. 24, 2003 at 6:06 AMLet's go through the charts, so Baby will know we care.

Report this post as:

bush admirer = simple simonby x Friday, Jan. 24, 2003 at 6:13 AM

over and over and over again, the two of them show up at the exact same time. This has happened for weeks.

Report this post as:

WHAT?by Mike Friday, Jan. 24, 2003 at 6:49 AMTax them too much and they might just not show up. You know, you had me going until that point. Is that a threat?? Oh, you must mean when corporations create huge tax breaks for themselves, or when they figure out funny accounting not to pay taxes at ALL. Is that what you mean by not show up at the table? So the message is, better be nice to the rich or they won't pay their taxes. Come on, they don't pay their taxes anyway! That's what they're asked to pay. You're not taking account write offs and business accounting.

Report this post as:

a little quiz....by lynx-11 Wednesday, Mar. 19, 2003 at 3:06 AM1. What percentage of the world's population does the U.S. have?

Report this post as:

He has the rightby Jeff Wednesday, Mar. 19, 2003 at 3:40 AMHe has the right to say what ever he wants. As Americans we are free that way. These freedoms came from defeating our enemies.

Report this post as:

|