rob_rogers.gifl1pdqq.gif, image/png, 400x287

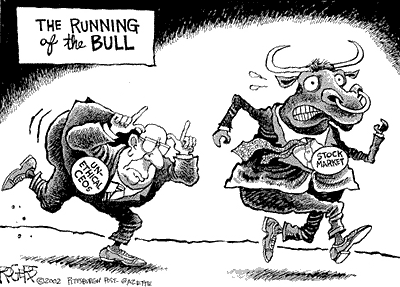

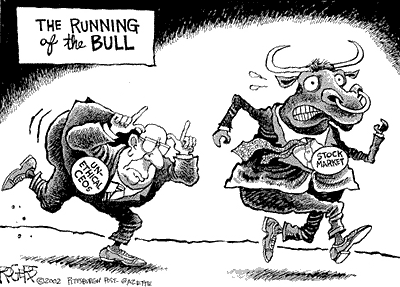

There's a negative correlation between executive pay and common sense -- the higher the compensation, the greater the temptation to think you're the smartest guy in the room.

rob_rogers.gifl1pdqq.gif, image/png, 400x287

Corporate Board Member Magazine, June 9, 2004

Don't Always Rely on the Smartest Guy in the Room

Summation

Ordinary citizens not versed in the close working relationship between senior management and corporate counsel might, when contemplating the long list of recent company scandals, pose a naive question:

What the hell were these business giants thinking?

What, a novice might ask, prompted the chiefs of Italy's Parmalat to think they could keep their enormous shell game of fictitious revenues and bank accounts going indefinitely? Or the wizards of AOL to assume they could convince Wall Street that online advertising was soaring when, as continuing inquiries by the Securities and Exchange Commission seem to suggest, much of the revenue came from asset sales? Or the titans of the mutual fund industry to think they could rip investors off in myriad ways for decades and not get caught?

Clearly all of them had sought the advice of competent counsel. If there is anything managers and board members have learned from the last few years' unpleasantness, it's that no one should neglect this important step before embarking on a life of crime. But seeking counsel is one thing and having the common sense to know what to do with it is another, and the two are as far apart as six months of community service and a six-year stretch at Sing Sing.

Only a comedy writer, for example, could imagine an independent attorney assuring Tyco International's Dennis Kozlowski that he'd escape prosecution for such excesses as spending ,000 of company money on a shower curtain. ("Nobody will notice. If you can get Tyco to fork over million for your wife's birthday party in Sardinia, you sure don't want to stint on your bathroom.") Or advising WorldCom's Bernie Ebbers, HealthSouth's Richard Scrushy, and Adelphia's Rigas family that it was okay to take vast sums out of their companies. ("You've created shareholder value, so you've earned the right to milk this cow all you can before she croaks.")

Actually, there are other explanations. One is that none of the above-mentioned malefactors could foresee just where his or her actions would lead. Psychologists call this process "commitment and consistency." You do something that looks reasonable, and the result of that act leads you to take another reasonable-seeming step, and so on until you arrive at a disaster you didn't anticipate because you got there one reasonable step at a time. It must have seemed logical to Martha Stewart that her little white fib about the stock sale--which was likely to have earned her a mere wrist slap if confessed early--had to be maintained so she wouldn't look like a liar.

Another explanation is what I call "fiduciary co-dependency." Your accountant lets you get away with actuarial whoppers because she knows that if she doesn't, you'll get a new accountant, who will let you tell even bigger porkies because she doesn't want to be replaced by a more pliable bean-counter either. Ask the folks at Andersen about that one.

But my favorite theory is the Morrison Coefficient, probably because I named it after me. That's the negative correlation between executive pay and common sense. The higher the compensation, the bigger the blunder--or more precisely, the greater the temptation to think you're the smartest guy in the room, as the top guns at Enron liked to describe themselves. And when the other people in the room are your lawyers, the results can be catastrophic.

That's doubtless why Sam Waksal ignored the obvious legal strictures on insider trading when he learned that his big new cancer drug, Erbitux, was about to get a regulatory thumbs-down. I built a billion-dollar company on the strength of my demonstrable genius, he no doubt told himself, so I don't need no stinkin' lawyers. Poor guy. If only he'd been dumber, he'd have held on until this year, when the drug was finally approved and ImClone stock soared. Some clients are just too smart for their own good.

www.boardmember.com/issues/archive.pl?article_id=11978

Original: You can trust corporations to Cheat, Lie and Steal